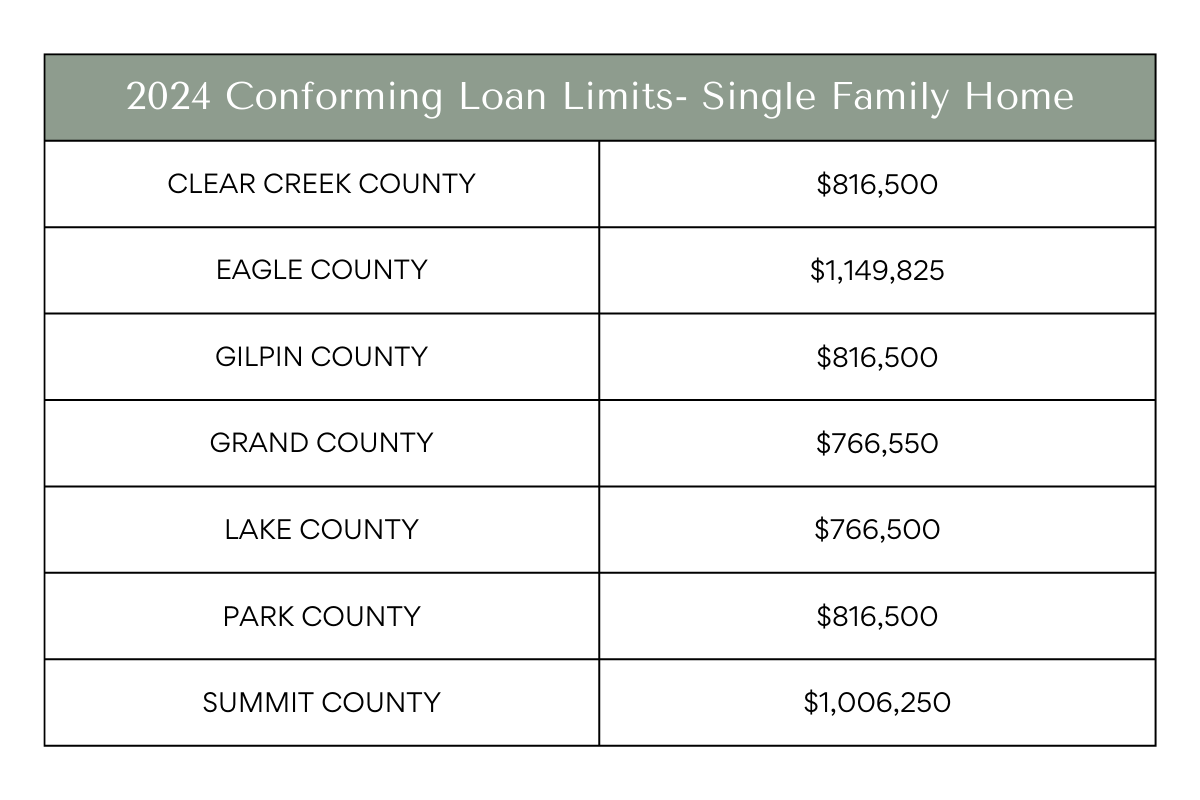

Fnma Conventional Loan Limit 2025 Limits. It covers 1980 through 2025. The exact conforming loan limit varies depending on the median home value in a given area, up to 150% of the baseline conforming loan limit.

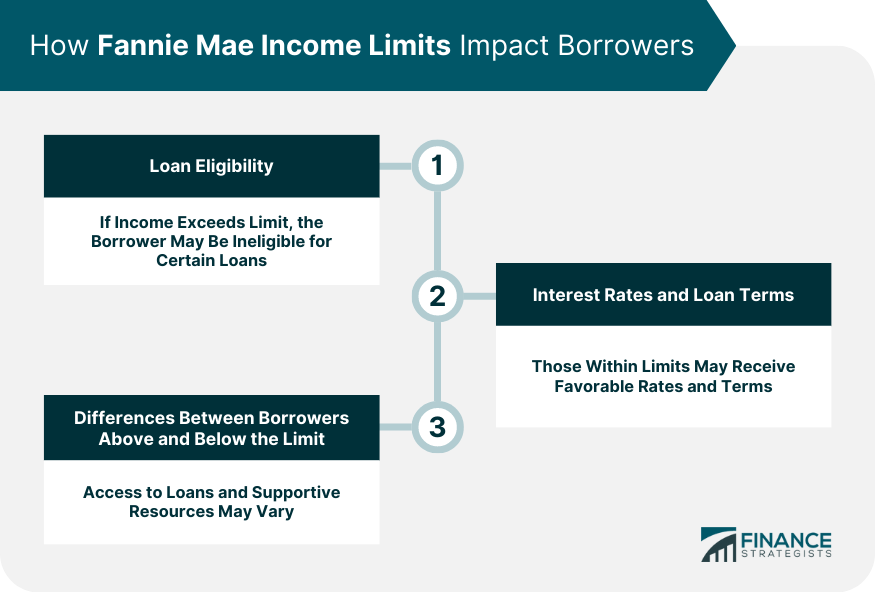

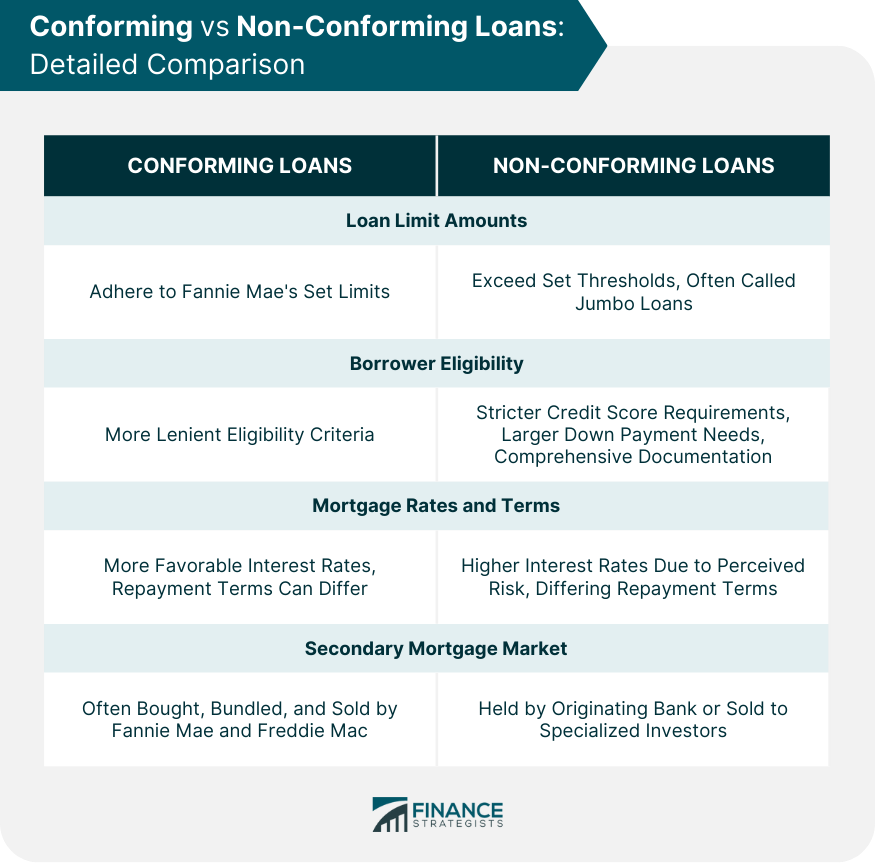

Conforming loans are backed by fannie mae and freddie mac and can’t exceed fhfa loan limits ($766,550 in most areas). Explore 2025 fannie mae loan limits, determinants like hera & inflation, impact on borrowers/lenders, and differences with fha & va loan limits.

Fannie Mae Conforming Loan Limits 2025 Finance Strategists, The projected increase in 2025 is approximately 3.28%, resulting in a new conforming loan limit of $750,000, up from $726,200 in 2025.

2025 Conventional Loan Limits Price Mortgage, The conforming loan limits for 2025 have increased and apply to loans delivered to fannie mae in 2025 (even if originated prior to 1/1/2025).

2025 Conforming Loan Limits *Preview* (Video) The Kristoff Team, The projected increase in 2025 is approximately 3.28%, resulting in a new conforming loan limit of $750,000, up from $726,200 in 2025.

Fannie Mae Conforming Limits 2025 Phebe Brittani, The projected increase in 2025 is approximately 3.28%, resulting in a new conforming loan limit of $750,000, up from $726,200 in 2025.

Simplifying Conforming Loan Limits The Skinner Team, The federal housing finance agency (fhfa) establishes fannie mae's loan limits for 2025, defining the maximum conventional loans that fannie mae can acquire.

Conventional Loan Limits 2025 Maxie Rebeca, Are covered by the standard loan limit, which is $ in 2025.

Fannie Mae Limits 2025 Cyndie Carolyn, The baseline conforming loan limit for mortgages backed by fannie mae and freddie mac in 2025 will be $766,550, up 5.5% compared to the current limit of $726,200, the federal housing finance.

Conforming Loan Limits 2025 Now Up To 766,500, The exact conforming loan limit varies depending on the median home value in a given area, up to 150% of the baseline conforming loan limit.